Published at 24th Apr 2018

Modified at 7th Jan 2024

Silver Coins

Why buy gold when you can buy silver?

Silver is a store of wealth but it’s also cheaper and has more industrial uses than gold. If you’re bearish buy gold if you’re bullish buy copper and if you’re confused buy silver. Confusion sums up this environment given negative interest rates and swings in the dollar and markets it seems like now is the time for silver. Silver has been regarded as the poor man’s gold for too long.

The ratio of gold to silver prices is the highest for many years. It’s a great opportunity for investors. Bullion buyers and strategists monitor this ratio as a signal to buy or sell bullion. A lower ratio means gold is a better investment a higher ratio means silver adds more value for your dollar.

The ratio is surprisingly back to where it was in the panic days of the Great Financial Crisis when investors piled into gold. Pre 1900 the gold to silver ratio was stable at 16x. Julian Jessop, head of commodities research at Capital Economics Ltd.in London states silver may climb to US $21 per ounce from the April price of US$16 per ounce. 2018 will be the first time in modern history that silver mining production will drop but demand is expected to increase. Over 50% of demand is from electronics, cars and solar.

Even coin demand is increasing in the USA 44 million silver eagle coins were minted last year compared to 9.2 million in 2000. Canadian maple minted 25 million coins in 2015 compared to 400,000 in 2000.

Negative Interest rates are here to stay and are trigger point to silver price increases. Why leave money in the bank and pay them to hold it for you? I know I’d feel safer with silver under the bed then paying the bank to hold my money.

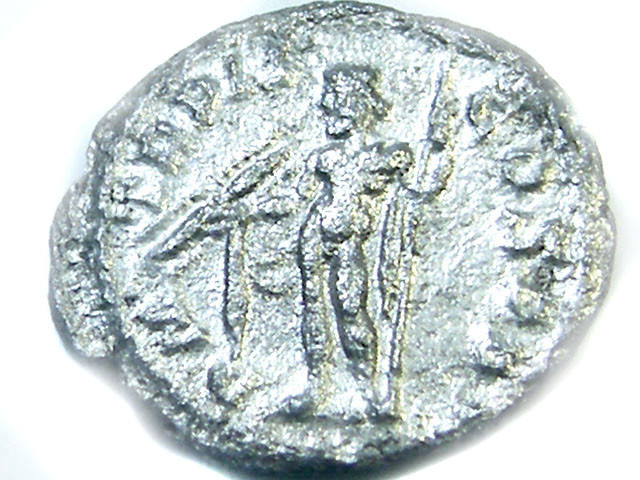

Silver has been used in coins for centuries.

The ancient Romans made silver coins for the Roman Empire but only Rome was allowed to make silver coins and all the countries that were made part of the roman Empire could only produce bronze, not silver coins.

The British made their pennies before 1797 from silver.

While the ancient Persians ,now Iran made silver coins between 612-330 BC

The Mexican Reales was the most common used silver coin for trade from 1500 to 1800.

The Greeks were the first to use silver coins, the famous Drachmas

Since than, silver has been held in high esteem when used in coins..

All countries have used silver in different percentages in ancient coins

USA coins minted Dime and Quarter coins from 1965 to 2009 have 9.21% silver content.

But after 1965 the USA did not mint any more silver coins till 1985.

The USA had huge stockpiles of silver but depleted these stocks in late 1960s

Some coins have higher silver value today than when the silver coin was made. For example the 1878 to 19212 Morgan Dollar is worth over $10 in silver content alone.

Silver has risen more than gold in the last 20 odd years due to the high demand in industry for silver.

In most corrections silver has doubled the price of gold and that is still true today.

Today more silver is used than mined above ground

.

In the infamous Y2K bug people bought vast quantities of silver coins but after the none event most of these coins were melted down.

Even the Romans at the end of their Empire, melted down their silver coins also as the silver value was worth more. now centuries later we are doing the same.

That is the power and history of silver coins.

Today many countries make Commemorative silver coins to mark a special event like Coronation, independence etc.

The Perth mint coins produces pure 99.99% one ounce silver coins which are very popular with collectors

The Australian 1966 0.50 cent coin has 0.3414 troy ounces so its silver content today is over $6.50

SILVER COINS AND GEMSTONES

The Perth mint has had a very successful range of one ounce silver coins in their Treasures of Australia collection

Coins and Gemstones make the perfect collectors series

Each series had a one ounce 99.99% silver coin with one carats of gemstones,Sapphire,Diamond and Opals.

Next in these series are the pearl and gold coin sets.

This series has the famous patented locket design which encases the gemstones in the coins .the coin is set in Jarrah wood top box with a certificate of authenticity.

The series of Treasures was limited to only7,500 coins per series and demand has been so great that the Mint has sold out several times over

The Treasures of Australia coins are also in gold ½ ounce and one ounce gold coins.

To compliment the gemstone and coin range

Treasures of the world have series of coins and gemstones for a collector’s series

As well as coins and gemstones in presentation boxes, gemstones will be available in beautiful cases also .

Gemstones treasures will include Opals ,sapphire, gold , pearls, Rubies ,Emeralds.

South African gold and diamonds series will include uncirculated south African 5 shillings coin and Australian series will include one ounce silver coin kookaburra and Koalas coins with sapphires and opals.

Silver coins are the most popular way to circumvent against price increase and balance selection risk in these turbulent financial times we live in. It has been traditionally been the most reasonable valuable metal

Silver prices have fluctuated wildly over the last decade and this base metal is used now days in many different industries Speculators come and go in the silver market But long term investors should have part of their portfolio in silver coins as they are easy to sell or trade. The western world ha s gone through periods of low inflation and when inflation starts it is good time to increase spending in silver bullion or coins.

Long term silver has been a reasonable investment but the more important strategy is not is silver increase up or down 5% but fact you hold actual silver instead paper so it is a relevant fall back situation for investors Chartists can plot when market starts to increase and when potential for down sizing They follow silver production and demand and lately demand has been high for silver in relation to mining But investors who enjoy the advantage of owing should ignore all these marketing hypes and just buy silver each month or each quarter regardless of the spot price Than easy to average your purchase out over several years.

With gold there is gold saying that one ounce gold coin will buy 350 loaf bread and silver has the same old saying

In 1950 as silver dollar would buy four gallons fuel and price will average the same in the future Those who hold and own silver will have advantage that they can cash out quickly if the need arises compared to property and shares

Heirloom silver coins

I can make statement today that I think silver coins as single or in sets will now be considered heirloom and I am sure silver coins will now be considered a personnel matter of leaving something of value to the next generation.

After the precious wedding ring silver coins will become known a pass down sentimental items for the next generation. My grandfather left me 50 silver .50 1966 coins and I still own them today and will pass down to my sons Proof sets silver coins are highly recommended and make sure they are stored away from moisture and or sunlight Some silver coins tarnish but best never to clean as many people scratch proof or uncirculated coins while cleaning Even silver coins kept in sealed envelope can tarnish if small tear or hole happens to the sealed envelope, but do not open leave as is.

There is also the cost of selling silver coin compared to long term holdings It is true you can easily exchange silver coin for silver cost for cash but not for numismatic value and I think numismatic value will also increase for uncirculated silver coins kept in good condition Start silver coin collection for enjoyment and consider as heirloom Wayne Sedawie 2010

Search the Coin Encyclopedia

Related Auctions

Related Articles

Why Do People Collect Coins? Collectors buy and collect coins for personnel pleasure and enjoyment or for an enjoyable investment. In late 1980s to early 1990s coin collecting was not so popular but now there is a re insurgence in collecting coins.

10th Jun 2009

From time to time you will come across an ancient coin with a hole on it. Coins that were holed in ancient times are intriguing. Why was this so?

12th Mar 2018

The first bimetallic coins can be considered some private issues dating from the 4th century AD

11th Apr 2018

Latest Articles

Washington quarters are 25-cent US coins issued since 1932. The original obverse remains, with dozens of varieties and new reverses. Learn the history, types, key dates, and errors on the iconic coin!

4th Nov 2024

Walking liberty half dollars are 50-cent American coins circulated from 1916 to 1947. The iconic design has been featured on the silver eagle bullion since 1986 and remains sought-after by collectors.

7th Oct 2024

Standing liberty quarters were circulated US coins issued from 1916 to 1930 as part of the Renaissance of American Coinage. Learn the values, varieties, and stories of standing liberty quarters!

9th Sep 2024

Article Categories

Collection of articles providing lots of useful information on coins through the ages.

30 Articles